AML GUIDE - Client Identification

The documents you will need to provide

The documents you will need to provide

AML - Anti Money Laundering

KYC - Know Your Client

AML/KYC regulations require that all clients clearly identify themselves and provide proof of residential address. Please see below for our AML requirements:

IDENTIFICATION

Document required (choose one):

You will need to upload this document to our online digital verification platform.

Document required (choose one):

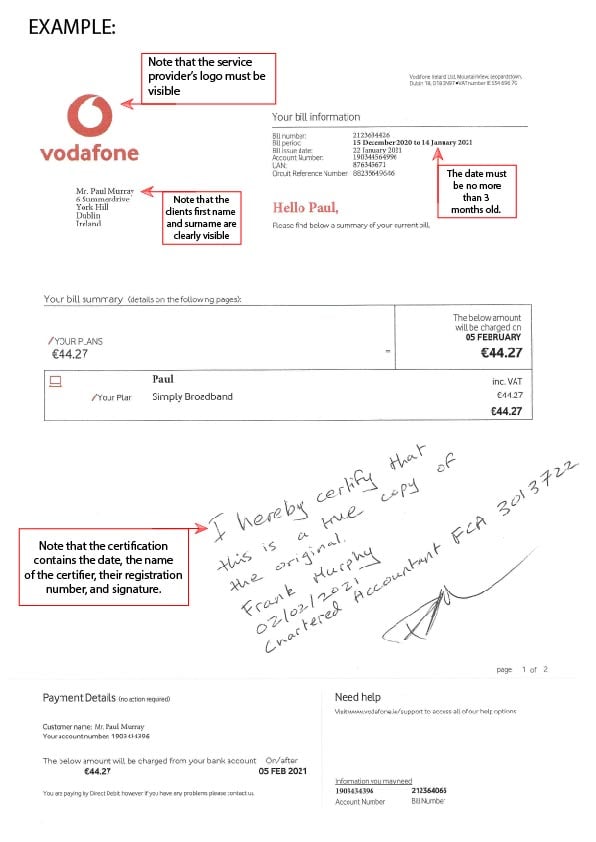

You will need to get a certified or notarised copy of this document.

An accountant, lawyer or Police officer can certify these documents.

EXAMPLE BELOW:

Having the correct AML/KYC documents is essential when doing business in Ireland and the EU.

If you have any questions don't hesitate to contact our office.

LEE JONES, FLUOROCHEM

"Working with Nathan Trust for our Irish company setup has been a positive experience. They helped us with everything, company setup, VAT registration and help with opening a Bank of Ireland bank account. Very responsive and great to deal with and they will continue to help us with accounting and bookkeeping in Ireland. Nathan Trust and Ireland are great options for any UK company looking to continue trading in the EU."

© Copyright 2024 Nathan Trust. All rights reserved.

Nathan Trust is the trading name for Millex Limited (CRO Number: 314738), is officially registered in Cork, Ireland, and operates under the regulatory oversight of Chartered Accountants Ireland (56679), Chartered Governance Institute (No: 1045242) and the Irish Tax Institute.